Amongst rising concerns around an incoming recession, landlords in Europe find themselves questioning the future of flex and the office sector at large.

As industry experts hungrily search for answers, new studies are emerging to help inform this topic, and one thing has become clear:

Flex isn’t just going to stick around, but grow exponentially.

London, the leading European city in flex office, is predicted to have its market penetration rate double from 6% to 12% by 2026 (Greenstreet Office Insights Report, 2022). Other sources emphasize the global explosion of the flex asset class by more than 700% in the next 8 years (CBRE, Global Flex Office Market Research Report, 2021). While it’s no secret that the data confidently shows a continued growth of flex, how will our current economic climate shape this trend?

We don’t claim to have all the answers, however, precedent shows flex is an incredible low-risk option during uncertain times. Whether a pandemic or recession, strategic flex office space can offer a landlord solutions for smaller assets, increased desirability for less than ideal locations, and rental uplift compared to traditional Class A and B office spaces.

A successful flex asset requires the right partner

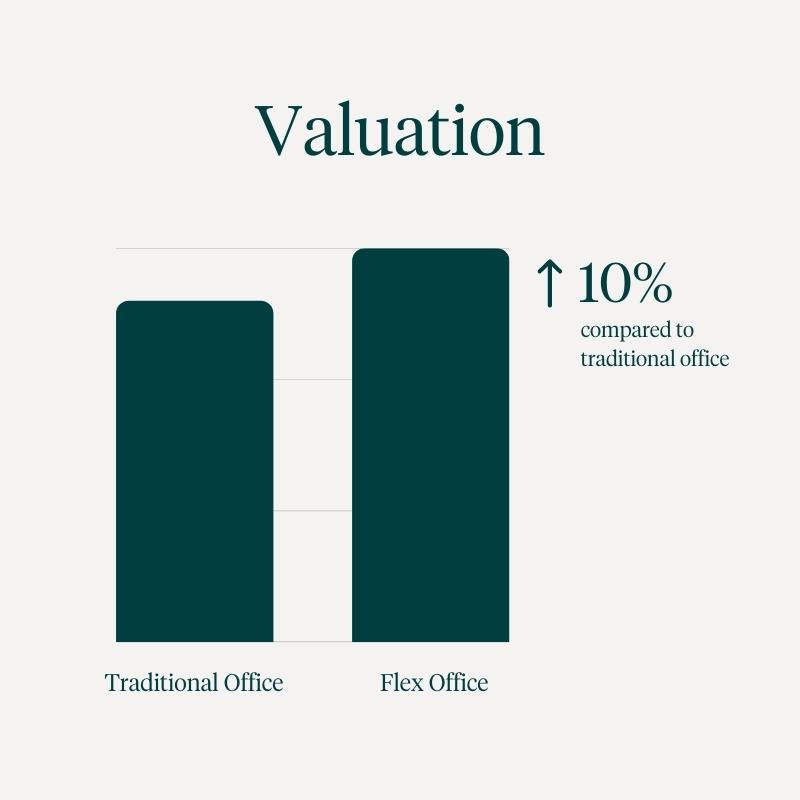

Well-managed flex office assets warrant roughly a 10% valuation premium compared to traditional office assets.

Well-managed flex office assets warrant roughly a 10% valuation premium compared to traditional office assets.

The ideal ratio of flex to traditional office space depends on the asset and location, however flex space should be positioned as a well-serviced amenity to existing occupiers regardless of size. In a recent study from Greenstreet, data shows that a well-managed flex office asset warrants roughly a 10% valuation premium compared to traditional office. While historically including more than 20% of flex space in a building tends to discount the asset, a healthy partnership between an asset-light flex operator and landlord reverses this discount (Greenstreet Office Insights Report, 2022).

In short, landlords that choose to partner with expert third-party flex operators experience an increase in building valuation as the assets are better poised to address tenant needs and an upsurge in requirement for flex in the building.

The enterprise perspective

Enterprise occupiers are currently faced with a unique challenge: prepare for a looming recession while also retaining talent through the most flexible and amenitized office experience possible.

The fact is, no company can do it all, but partnering with a strategic flex partner can fill in the gaps.

“With some corporates downsizing their traditional-lease HQs or outright abandoning them in favour of flexible office arrangements, enterprise demand could easily accelerate as HQ employees spill over. Even talk of a recession may spur demand for flex office as long as jobs don’t evaporate.”

Greenstreet Office Insights Report, 2022

From May of 2021 to May 2022, we’ve seen a dramatic increase in enterprise occupiers offering employees access to a national network alongside designated office hubs. Industrious has been able to offer enterprise occupiers the freedom to provide employees with dedicated office space and access to a global network, while avoiding the cost of a 10+ year lease on traditional office spaces in every applicable market.

Specifically, there was a 500% increase in our current enterprise accounts supplementing their main office space with access to our global network through the Access Pass product, and we predict that this will only continue to grow.

The landlord perspective

With up to a 61% increase in rent premiums and an average 16% increase in occupancy for highly amenitized buildings (compared to non-amenitized; Source 1, Source 2), adding in a quality flex amenity to any building can prove to be economically lucrative. A CBRE analysis from 2019 to 2022 found that effective rents for top-tier office buildings rose by 3.8% in 2021 and by 6.7% through Q2 of 2022. However, effective rents of lower-tiered assets fell by 3.4% and again by 1.1% so far in 2022. (Source).

Amenitized additions such as a well-managed flex space and a thoughtful tenant experience program are premium layers that can be added to any portfolio to boost a building into a “top-tier” option for key occupiers. In addition to rent and occupancy increases, partnering with a trusted flex partner can help them monetize unused space while giving key enterprise tenants the room to grow and expand within a building.

Conclusion

Adding a flex space offering to real estate assets can help increase valuation and drive foot traffic. As landlords and occupiers prepare for an uncertain economic climate, many are actively leveraging flex space partners to activate their assets and future-proof their portfolio.