Over the past 10+ years, the presence of flex office space has increasingly grown from novelty to office necessity. The pandemic accelerated the need for flexibility, and demand has followed suit—the asset class is predicted to grow by more than 700% in the next 8 years (CBRE, Global Flex Office Market Research Report, 2021).

However, many owners are concerned about the initial effect incorporating flex will have on building valuation, wanting to keep their properties ‘best in class’ and competitive with the broader CRE market. Several owners have added stand-alone physical amenity spaces that serve as a cost center, whereas flex office space increases revenue over time through above market rate rents and by increasing the overall value of the building as a whole.

A flight to quality and need for amenities are now deeply sought after components from occupiers, but as the capital markets adjust, there will inevitably be some knowledge catch-up. The prevailing question being:

‘Does flex office space impact asset valuation? If so, are there characteristics that inform whether impact is positive or negative?’

Our team has compiled a vast assortment of industry data from the most reputable CRE firms to help find the answer.

CRE professionals are aligned on flex office space’s benefits

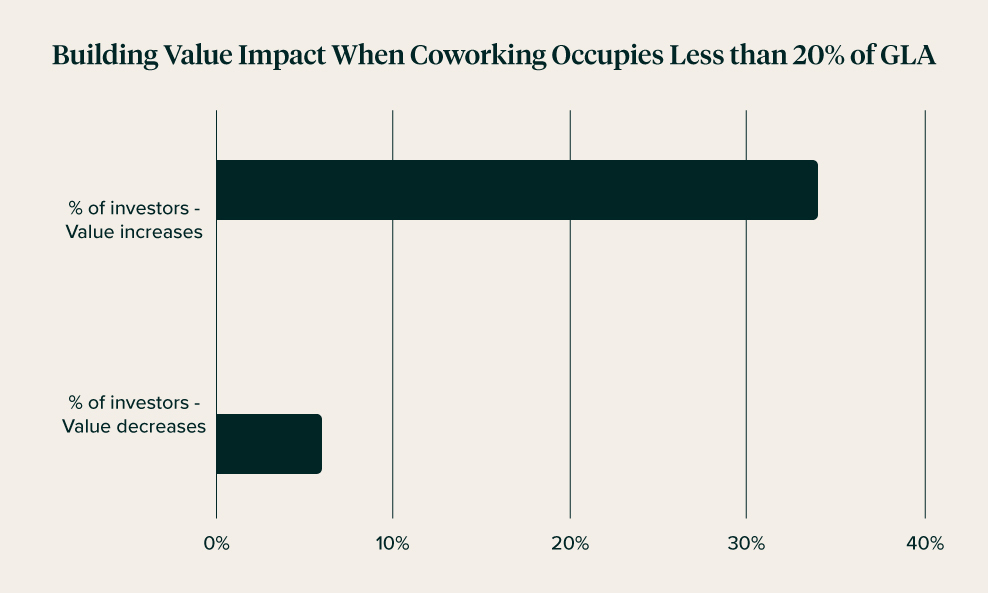

Even prior to the pandemic, investors believed that, contingent on size, the presence of flex had a net positive impact on valuation. In a study conducted by CBRE in January 2019, over 30% of investors believed a building’s value increased when flex comprised less than 20% of Gross Leasable Area (GLA). Less than 10% of the group surveyed believed it would decrease the value. In addition, the same report found that 81% of transactions including flex have lower cap rates than national average for Class A CBD office and 61% of cap rates were on par with peers when coworking is less than 40% of an asset (CBRE, US Property Value Implications of Flexible Space, January 2019).

In the current office climate, CRE firms and investors are even more confident in the presence of flex as a value add to any portfolio within a certain size range. JLL found in their 2021 Global Flex Space Report that a high concentration of cap rates were at or below par when flex space is <25% of GLA. Their research group later reported in their 2022 Flex Report that unless flex occupies more than 19% of GLA, there is an insignificant impact on building valuation.

Most flex transactions perform well compared to overall national and market-specific cap rate averages. Higher cap rates seem to correlate with a higher threshold of flex occupancy in a building, but factors such as building size, class, and location also play a significant role. CBRE found that more than 75% of Class A flex transactions had cap rates that were on par with their peers.

Industrious’ impact on building valuation

Our team engaged a global CRE firm to evaluate the impact of signing a 10+/- GLA deal with Industrious. Here’s what their Executive Vice President had to say:

“From a capital markets perspective, we believe the combination of the attractive build-out (showcase space), positive vibe of having a large coworking tenant, and the potential synergistic effect of tenant spin-offs will benefit the future sale process. Therefore, from a tenant desirability standpoint, we feel that purchasers will view Industrious in a very favorable light.”

Their team also found that the overall benefits of incorporating Industrious flex space within a building included:

- Significant office absorption during a period of anemic absorption related to the pandemic

- Above standard build-out showcases the space

- Flex space can provide leasing synergies when firms outgrow their space

- Potential upside from a management agreement producing above market rental income

Bottom line: Flex office space is one of the best ways to unlock your portfolio potential without compromising valuation.

As this sector of the office industry moves from novelty to office necessity, it’s imperative that landlords feel equipped to strategically use flex as a way to increase their building’s value, not diminish it.

Over our years of operating best-in-class flex office spaces, we’ve seen how strategically placed flex can unlock the potential of a building for maximum retention, tenant engagement, and overall usage. The data prove that flex is growing at an incredible rate and that further expansion into flex under 20-40% of a building will not hinder but boost the overall impact and value through tenant retention and engagement.